Tax filing blues giving you sleepless nights?

Tax Prep and Filing without mesha

Lack of tax expertise and knowledge

Uncertainty about eligible deductions

Challenges in keeping up with tax laws

Difficulty organizing tax documents

Feeling overwhelmed during tax season

Risk of missing tax deadlines and penalties

Limited support and guidance throughout

Potentially higher tax liabilities

Confusion during IRS notices and audits

Time-consuming tax preparation

Tax Prep and Filing with mesha

Access to expert tax advisors

Maximize deductions with tailored strategies

Stay compliant with up-to-date tax laws

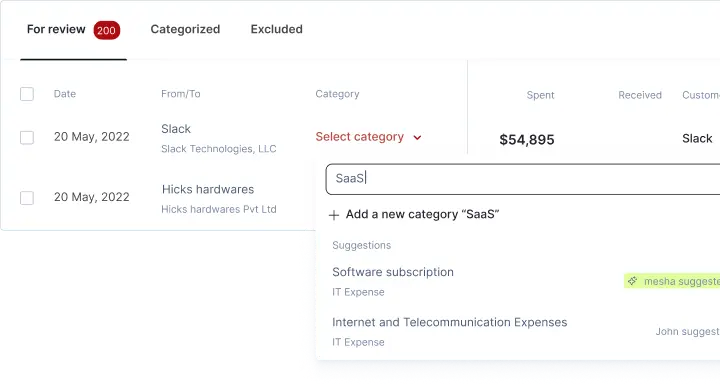

Securely submit tax documents

Enjoy stress-free tax filing process

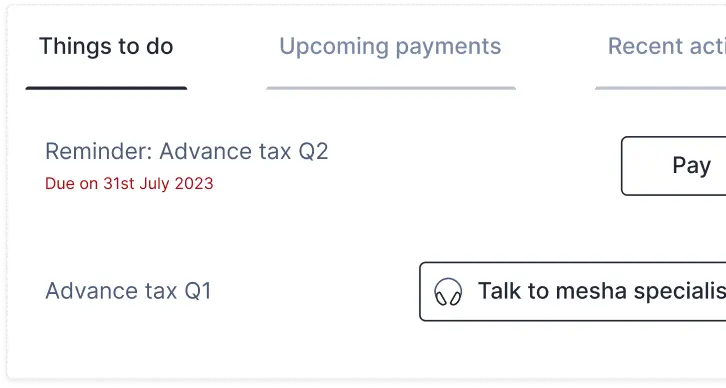

Keep track of important tax deadlines

Receive year-round support and advice

Optimize financial planning for tax savings

Expert assistance in IRS issue resolution

Streamlined tax preparation and filing

How it works

Step 1: Safely submit your tax documents

Kickstart your tax preparation process by securely sharing your essential business tax information, allowing us to pair you with the perfect tax expert.

Step 2: Meet your dedicated business tax advisor

We will connect you with a specialized expert who will comprehend your specific requirements, provide a tailored action plan and will help ensure you are benefitting from the latest tax laws.

Step 3: Embrace instant access to expert guidance

Stay informed about the progress of your tax preparation and receive unlimited support and advice from your designated expert whenever you need it.

Step 4: Collaborate on the final review and confirmation

Prior to filing, your expert will thoroughly review your return alongside you, guaranteeing accuracy and assurance.

Make tax season stress free

- Experience easy tax preparation and filing with our exceptional team of experts.

- Dedicated tax advisors ensure a stress-free tax season.

- Year-round support prevents missed deadlines.

- Our A-team delivers exceptional results for your tax return.

- Top-notch bookkeeping and tax services secure every eligible deduction.

- Maximize your tax benefits with mesha's expertise.

- Enjoy an all-in-one solution for tax, accounting, and bookkeeping with mesha.

- We take care of organizing, paperwork, and guidance every step of the way.

- Rest easy knowing your financial matters are in capable hands.

Behind on your tax filing?

No need to panic if you are behind on your business taxes for several years. Our proficient tax team would help you regain financial control and get caught up with the IRS.

- Immediate support: with IRS and state tax issue resolution

- Affordable pricing: included with our Tax Preparation and Filing plan

- Representation from our experts : to communicate with IRS on your behalf

- Regular updates: Check-Ins to notify you on your tax situation and updates

Upcoming tax filing deadlines

Form 1099-MISC - 31st January

If your business made payments of $600 or more to independent contractors or freelancers, you must file Form 1099-MISC with the IRS by January 31 of the following year.

Form 940 (Federal Unemployment Tax Act) Filing - 31st January

Employers must file Form 940 annually to report federal unemployment taxes. The deadline for filing this form is usually January 31.

S Corporation and Partnerships - 15th March

S corporations and partnerships have a tax filing deadline of March 15. File Form 1120-S for S corporations and Form 1065 for partnerships by this date. You can request an extension until September 15 with Form 7004, but pay estimated taxes by the original due date to avoid penalties. Stay compliant by planning ahead and meeting these deadlines.

Form 1042-S - 15th March

For businesses making payments to foreign individuals or entities, Form 1042-S must be filed with the IRS by March 15.

Sole Proprietorship and C Corporations - 18th April

April 18 is the tax filing deadline for sole proprietors filing Schedule C (Form 1040) and C corporations filing Form 1120. You can request an extension until October 16 using Form 4868, but remember to pay your estimated taxes by the original due date to avoid penalties.

Maximizing Deductions:

With customized tax consultation, businesses can identify and take advantage of all eligible tax deductions, credits, and incentives. This leads to reduced tax liabilities and increased tax savings, freeing up more funds for business growth.

Compliance and Avoiding Penalties

Tax laws and regulations can be complex and ever-changing. Customized tax support ensures that businesses stay compliant with the latest tax laws, reducing the risk of costly penalties and audits.

Strategic Tax Planning

Our tax consultants work closely with businesses to develop effective tax planning strategies. They help structure transactions, investments, and business decisions in a tax-efficient manner, optimizing your overall tax outcomes.

Year-round Support

Our tax support is not limited to the tax filing season. With customized consultation, businesses can access year-round support, enabling them to make informed financial decisions at any time.

Focus on Core Activities

By delegating tax-related responsibilities to experts, businesses can focus on their core activities, improving productivity and efficiency.

Frequently asked questions

What are the benefits of hiring a tax consultant for my business?

A tax consultant can help you maximize deductions, minimize tax liabilities, and ensure compliance with tax laws. They offer personalized strategies to optimize your financial planning and provide expert advice for better decision-making.

How can tax planning help my business save money?

Tax planning helps identify tax-saving opportunities, such as eligible deductions, credits, and incentives. By strategically structuring transactions and investments, you can reduce taxable income, leading to significant tax savings for your business.

What types of tax services do you offer?

Our tax services cover a wide range of needs, including tax preparation, filing, and planning. We offer assistance with corporate tax returns, individual tax returns, sales tax filings, payroll tax filings, and more.

How often should I seek tax consultation for my business?

For optimal results, we recommend seeking tax consultation at least once a year, preferably before the tax filing season. However, if your business undergoes significant changes or financial events, seeking advice more frequently can be beneficial.

What steps should I take if I receive an IRS notice or audit?

If you receive an IRS notice or face an audit, don't panic. Contact our tax experts immediately, and we'll guide you through the process. We will help you respond to the IRS and provide the necessary documentation to resolve the issue efficiently.

Can you assist with tax planning for future investments and business expansions?

Absolutely! Our tax consultation includes strategic planning for future investments, expansions, and major financial decisions. We will help you understand the tax implications and structure your plans for optimal tax efficiency.

Can my incorporated business file an extension?

Yes, incorporated businesses can file an extension using Form 7004. For C corporations, the extension provides an additional six months, moving the due date from April 15 to October 15. For S corporations, the extension shifts the due date from March 15 to September 15. Remember, the extension only applies to the filing deadline, not the payment deadline, so estimated taxes must still be paid by the original due date.

What documents do I need to file Form 1065?

You will need the following documents:

- Business information (name, address, EIN)

- Partner information (names, addresses, SSNs/TINs)

- Schedule K-1s for each partner

- Financial statements (balance sheet, income statement, cash flow statement)

- Income and expense records

- Documentation for deductions and credits claimed

- Depreciation schedules for assets

- Any additional forms/schedules depending on partnership activities (e.g., Form 4562, Form 8825)

What happens if I get audited by the IRS?

mesha tax advisors will offer expert guidance, help you gather required documents, and act as your representative during the IRS audit. They'll defend your position, assist with appeals, review tax compliance, and provide peace of mind throughout the process.